The Revolut application is a revolution in electronic banking. The most important of them is a free multi-currency card assigned to the account. With the Revolut card you can travel the world and pay in over 150 currencies at the real exchange rate without additional commissions (with few exceptions), and have 30 currencies in your account. We can pay with physical, virtual and one-time cards, also with the phone thanks to Apple Pay and Google Pay, or with transfers between users. The card also allows for free cash withdrawals at ATMs around the world up to the limit specified in the plan.

The Revolut application is many other benefits such as international transfers, savings, purchase of shares, cryptocurrencies. In this post I will tell you why I use Revolut cards, how to start using and what to look for to avoid unnecessary costs.

What is Revolut?

Revolut is a so-called fintech that was founded on July 1, 2015, introducing a technological revolution in the world of finance. Which can be admitted to him that he succeeded. Revolut already has over 20 million customers around the world, including over 1.7 million in Poland alone. Revolut services are available in more than 36 countries around the world and employ more than 5,000. People.

In 2018, Revolut received a bank guarantee from the Bank of Lithuania, thanks to which it obtained a guarantee of funds. This brings measures 100 thousand the euro is backed by the European Deposit Guarantee Scheme, and in addition, Revolut can also offer loans to the consumer.

Why did I choose Revolut?

If you want to travel the world, you need to prepare for various expenses such as:

- Tickets

- Accommodation

- Transport

- Food

- Leisure activities

- Shopping & Souvenirs

They will also probably want to have some cash on hand. If they are dollars or euros, it can be embraced even in Polish banks.

For most of these things you will have to pay in a foreign currency, even if the prices given on the website are in PLN, it may be that the amount debited from your account will finally be in the local currency. It is worth being prepared for this so as not to pay extra for currency conversions.

Sometimes it is even worth staying with the currency in which the website or premises operate by default, because although it accepts payments in PLN, the currency conversion can take place at the payment gateway or on our account. On small amounts you will not feel it, but paying already 300 euros (about PLN 1400) from the account in PLN, the banks offer a very unfavorable Spread in the amount of often ok 6-8% and it has its own buying rates of currencies (other than on the Forex market), we can overpay about PLN 40-50 on such a transaction.

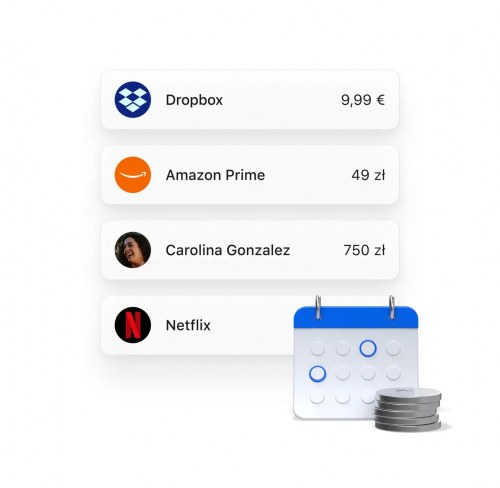

Pay for services and subscriptions with a Revolut card

With the rest, in the era of services and subscriptions, it may also happen that you pay for services such as Adobe or Google Workspace and your card is charged in euros. If you do not have a multi-currency card or a favorable service in the bank, you will certainly be charged for such transactions. You can have as many as 6 virtual cards, so you can divide them into different services and set a transaction limit so that no one will charge you beyond what you set.

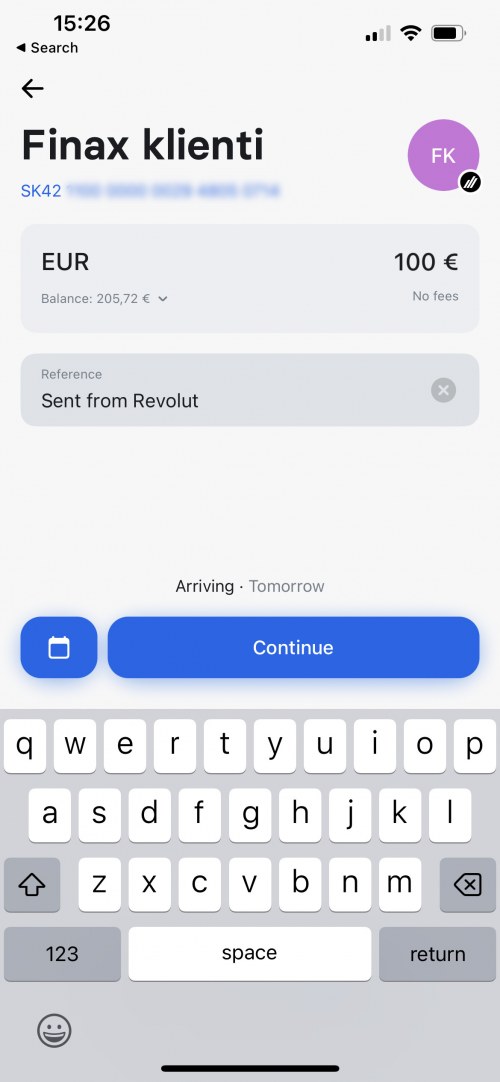

At the moment, quite a few different Fin-techs have already appeared that offer multi-currency cards, but the most popular of them at the moment has become the British Revolut. For some, this is another “App” or service that is not fully a bank. Despite this, it already has banking licenses in the UK and the EU, which makes it, as they call it , an electronic money institution. Which gives us the opportunity to obtain a Polish, European (Lithuanian) or British IBAN number, which allows us to make foreign transfers at a low or zero cost. At the moment, when making a transfer in euros from Revolut (with Lithuanian IBAN) to Slovak Finax, which also has an account in euro, I do not pay any commission for transfers in euros.

Why do I prefer Revolut to a multi-currency card at mBank?

Now many banks offer free multi-currency accounts or multi-currency cards, but in practice it is not so colorful. In my case, mBank offers the possibility of creating accounts in 11 currencies (vs 30+ in Revolut) and then my card detects the currency in which I want to pay to download from this account. Only to do this, I have to convert zlotys beforehand, for which the bank will charge me earlier. In Revoluta I have a currency conversion at the best rates and I do not have to have this currency on my account beforehand, because it happens on the fly. In mBank, then I wondered what to do when I had dollars left on my account, because by exchanging them for PLN I would lose again.

Fees for multi-currency cards

If in mBank I do not have a given currency on the account that I want to pay, it will charge me a commission of 3.5% , so you have to watch. Previously, you had to have a separate card for a specific currency in EUR, USD… and also make sure that they do not charge us some fee for their possession. At the moment, this is a lichen service on a regular card with hooks.

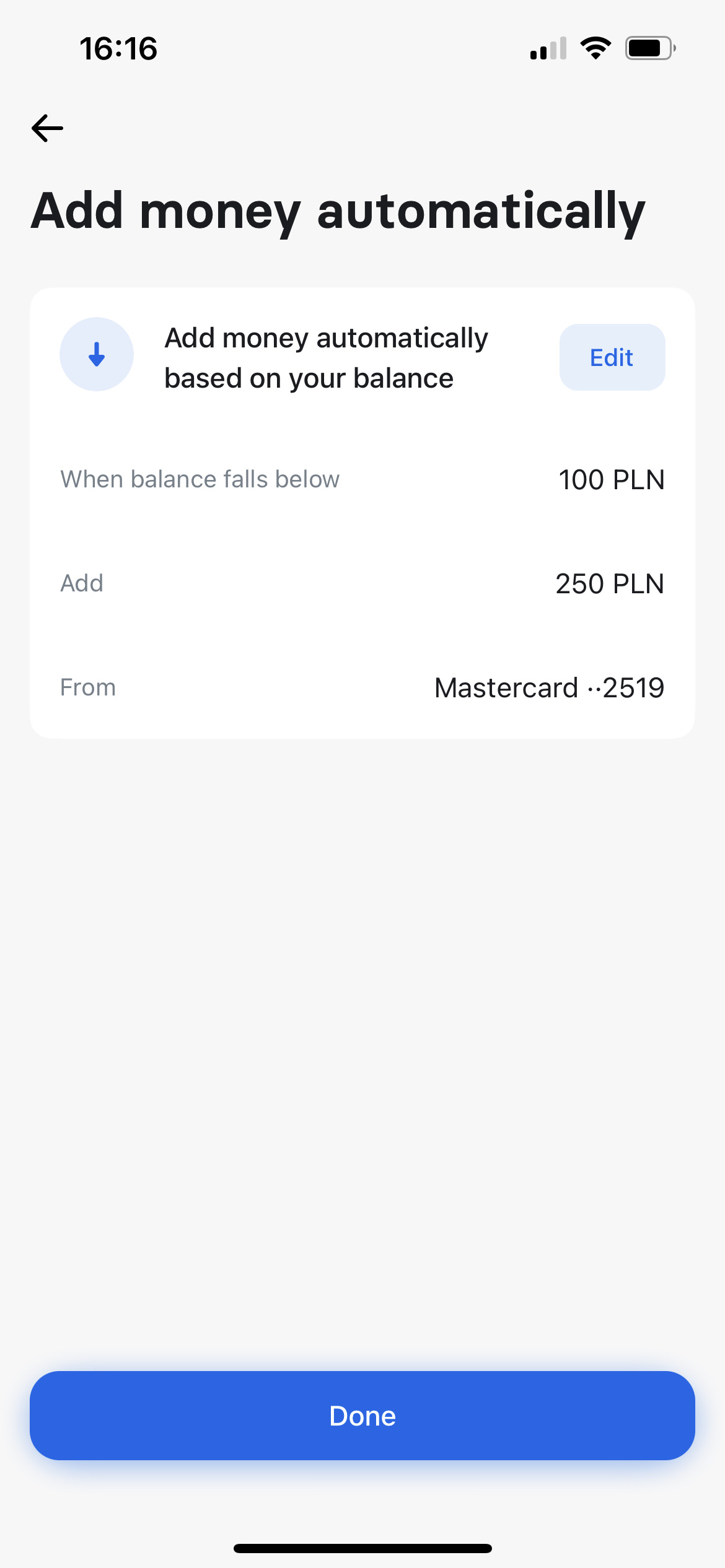

In general, I know that Polish banks like to take advantage of our inattention and laziness, which they can earn very well. That is why I now use Revolut cards more often, which I top up with the mBank card (which protects me from a fee) on which I also have transaction limits. To other accounts, I do not have cards connected at all, so I can sleep more peacefully. Revolut itself is treated as a Pre-Paid card (in a way, yes, because we top it up with a transfer, another card or Apple Pay / Google Pay), but I think that you can use it as a regular card and protect yourself on several levels, thanks to the fact that we can top it up manually or automatically in a given way, and set separate limits and payment methods for each card.

Already a few years ago I even managed to rent a car in Mallorca with a Revolut card, and puki what is only Wizzair does not want to accept Revolut payments on board planes, which does not bother me, because they are usually short flights, and I buy perfumes from Prouve . It is not known for what reason, because he saw opinions on the web that the transaction passed. I paid myself in Lot and there was no problem. I suppose that because the transactions are offline, the “clever” travelers bought something for an empty or blocked account and Wizzair could not get the cash from them.

When is it worth having a card from a Polish bank?

Of course, there are different situations and it is worth being prepared for everything – we will lose the card, someone will steal it from us, or pull it in an ATM. Some situations can be solved from the app and lock the lost or stolen card and create another one in the app. However, for withdrawals from ATMs, it is worth having an emergency physical card, where you can enable the option of a multi-currency card and despite higher fees, have at least such a possibility.

The second situation is that Revolut free plans offer cash withdrawals only up to the equivalent of $ 800, then it is a 2% commission. So if you want to have more cash, it is worth counting whether we do not have a better option in the bank. Although often this 2% commission can still be better than using a card from a Polish bank.

If your trip is two months, because you fly at the end of one, and you come back in the next, you can also divide your payment for two months and draw PLN 800 in one and PLN 800 in the other. 😉

What currencies does Revolut support?

At Revolut, we can pay in over 150 currencies and have over 30 currencies on our account. These 30 currencies can be exchanged in advance and have them directly on your account. All the rest will be converted at the time of the transaction at the interbank rate (at the weekend there will be a commission of 1-2%).

The currencies you can have on your Revolut account are:

- Euro – EUR

- British Pound – GBP

- US Dollar – USD

- dirham from UAE

- Albanian Lek – ALL

- Argentine peso – ARS

- Australian dollar – AUD

- Azerbaijani manat – AZN

- Bangladeshi Taka – BDT

- Bulgarian lev – BGN

- Bahraini dinar – BHD

- Bermudan dollar – BMD

- Brunei dollar – BND

- Bolivian Bolivian Boliviano – BOB

- Brazilian real – BRL

- Bahamian dollar – BSD

- Botswanan pula – BWP

- Canadian dollar – CAD

- Swiss franc – CHF

- Chilean peso – CLP

- Chinese yuan – CNY

- Colombian Peso – COP

- Costa Rican colon – CRC

- Czech koruna – CZK

- Indian rupee – INR

- Icelandic króna – ISK

- Norwegian krone – NOK

- Romanian leu – RON

- Thai baht – THB

What is the currency exchange rate in Revolut?

When paying with a Revolut card, we make payments free of charge at the interbank rate (FX) and you can check it immediately in the application. If we want to exchange currencies on the account, we can do it immediately at the current rate or set the order at a predetermined rate – if one appears. In this way, we can track exchange rates and buy currencies in advance when their rate falls, and then pay with them.

There is only one condition. Within a month, we can exchange currencies up to the equivalent of PLN 5,000. Then there is a 0.5% commission. There is no such limit on paid plans.

Course on weekends

It is also worth remembering to exchange some currency before the weekend if you want to pay with it, because at the weekend (London time decides) a commission of 1% is added, and in the case of Ukrainian hryvnias (UAH) and Thai baht (THB) 2%. The same applies to the withdrawal of cash. In this way, having the currency on the account, we will avoid commissions. This is probably because exchange rates do not change on the weekend, but stop on Friday (17:00 New York time), until Sunday (18:00 18:00 New York time) and for safety they add us this 1-2% more to buy currency, as a buffer.

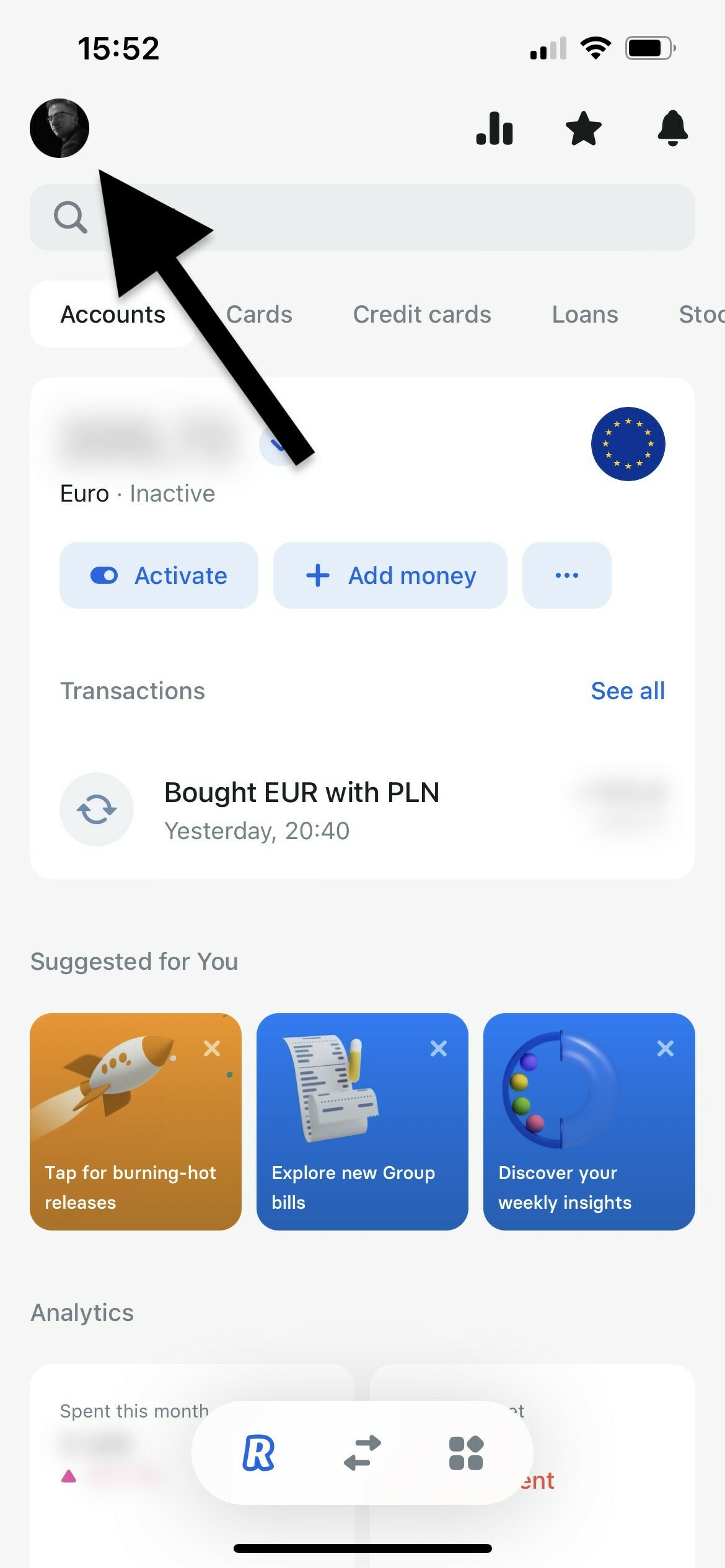

How do I top up my Revolut account?

Revolut account can be topped up from PLN 50. The simplest option at the moment is Apple Pay and Google Pay. You can also enter your card details from a Polish bank – payments will be charged in PLN as for payment on the Internet. We can also make an easy transfer from ING or mBank, or using a regular transfer from another bank to Polish account number that Aion Bank provides to Revolut. We can also make SWIFT transfers to the Lithuanian account number, but banks can charge a commission from them.

How do I withdraw money from Revolut?

The easiest way is to withdraw money at an ATM, whether in Poland or abroad. We can also make transfers, here a lot depends on the banks. Revolut itself informs what the commission is when placing an order. When making transfers in PLN and euros, I have not paid a commission even once.

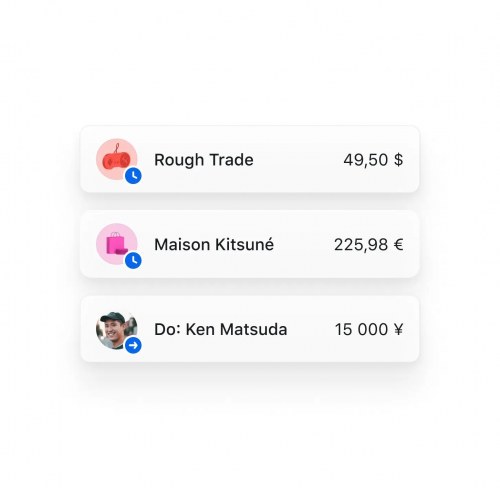

Peer-to-peer transfers in Revolut

We can also transfer money to other Revolut users without commission. Such a solution is also increasingly used by companies and I have already paid in this way in a pharmacy, hairdresser or for attractions in Dubai.

A very convenient option on trips or even on a daily basis is to divide bills between users. We can do this on individual transactions or create a whole account that we can divide into several people, along with information about who has already settled. With friends in this way we can divide the bill for pizza or shopping in a liquor store.

How much does a Revolut card cost?

Creating a Revolut account is completely free and you can do it directly from the app. Actually, this is also the only option, because Revolut does not have physical shares of banks and everything is done online. We also do not pay for using the application as long as we do everything within the limits. If we have to pay for something, e.g. during a transfer or purchase of cryptocurrencies or shares, we always have information about the commission to pay.

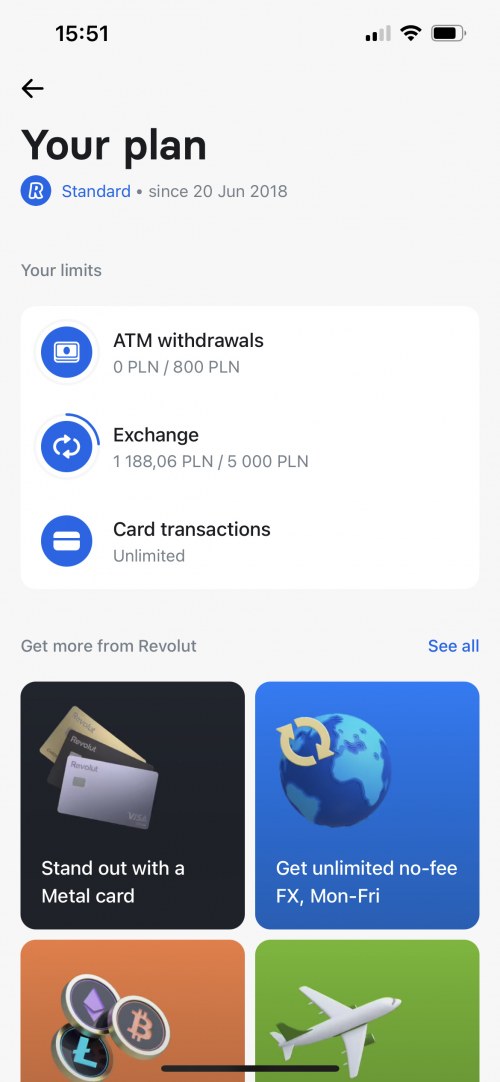

The main limits on the free Standard account are:

- Withdrawals from ATMs (PLN 800 per month, or up to 5 withdrawals. Then 2%, not less than 5 PLN)

- Currency exchange (5000 PLN per month. Then 0.5%)

There is no limit to card payments.

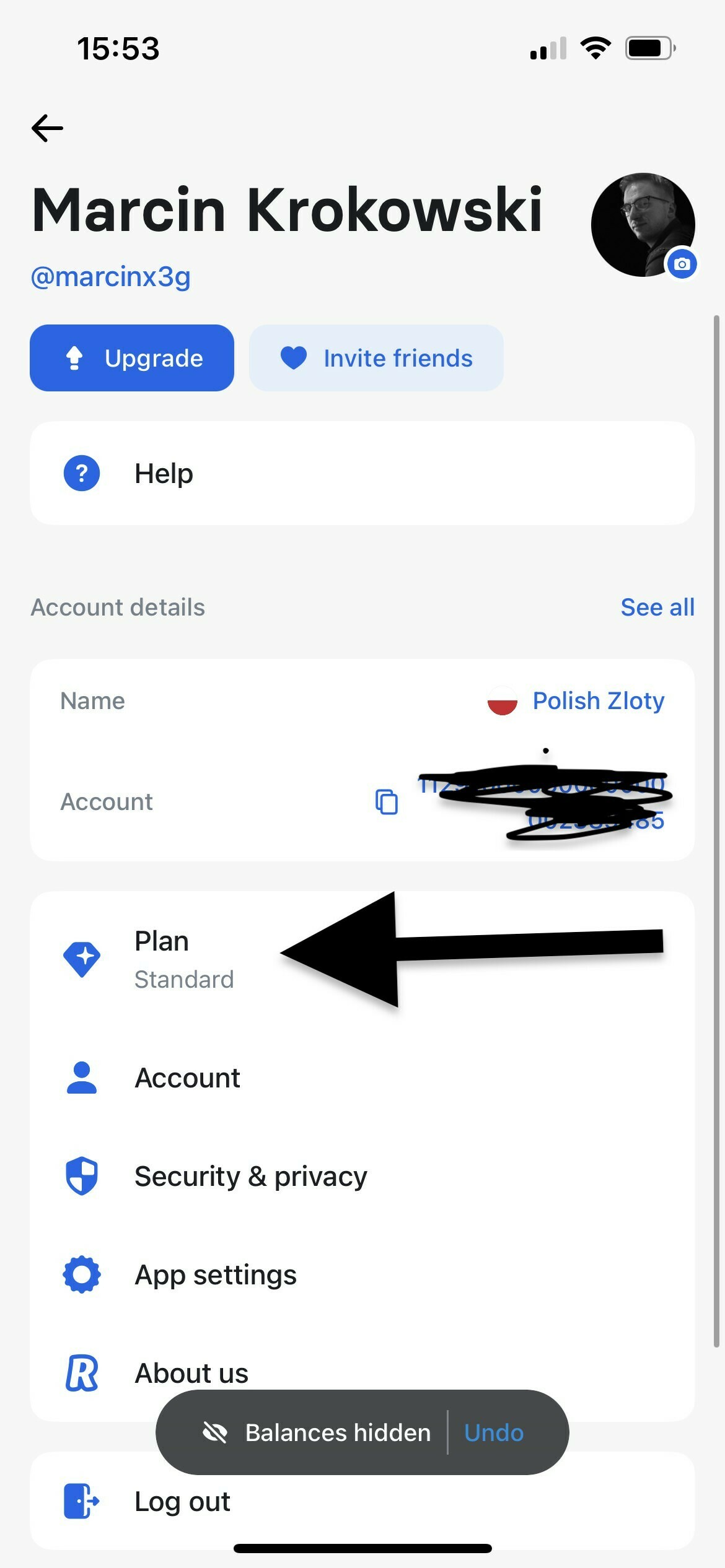

You can check everything by going to your profile in the upper left corner of the application, and then clicking on Plan.

Free Revolut Multicurrency Card

At the moment, a physical card for a free plan costs 24.99 + 28.99 zł per shipment, but often Revolut offered it for free. Even if you pay for the card, it is a one-time fee and if you do not exceed any limits, there are no surcharges for using it. My free card has already expired once and I got another one for free.

If you do not want to withdraw cash – abroad you usually need a physical card, then you can use a virtual card and connect it to Apple Pay and Google Pay and pay with your phone / watch, as well as enter into applications such as Uber, Bolt, Booking, Airbnb, etc.

Personally, most of the time I do not have a physical card with me, because I usually use it 1-3 times per trip to withdraw cash, or some terminal does not want to accept contactless payments.

You will order a physical card, just remember to activate it. Usually you have to use it physically in the terminal and enter the PIN.

Types of Revolut cards

I can choose from 3 types of payment cards – physical, virtual and one-time. Of which we can have as many as 6 physical cards, 5 virtual cards and 1 one-time card. Usually, we should only need one physical card, which will be useful for withdrawals at ATMs, and 1 or more virtual cards. All except one-time, can be connected to Apple Pay and Google Pay, which gives a lot of convenience and security.

We can only really take a physical card on trips to withdraw cash and possibly use it in rare cases when contactless payment with a phone or watch will not pass you.

Revolut Card Security

Revolut cards have a lot of security options available directly from the app. You do not have to call the bank to use something. We have everything right away.

From the application level, we can:

- freeze the card (without having to order a new one)

- change limits

- enable/disable on-line transactions

- allow GPS transactions

- enable/disable magnetic stripe transactions

- enable/disable ATM withdrawals

- enable/disable contactless payments

In this way, we can have ATM withdrawals blocked by default and activate it only at the beginning of the trip, when we want to withdraw some cash, and then only pay by card. If we lose the card, we can also block it immediately, and if we only lost it, then activate it again, without making another one.

Thanks to these safeguards, we can have several cards for different needs, with different functions, limits. I myself have a separate card only for online payments, so that in case of problems with the physical card on vacation I do not have to worry that all services will have to be connected to a new card. By the way, Revolut has the option of disabling payment for subscriptions, if we can not cope with it using some service and they constantly charge us.

Sometimes I also met with a request to verify an unusual or high transaction. It was rare, so I’m not nervous. However, I can feel safer if every transaction is analyzed in terms of potential theft of our funds. This is due to, among other things, Sherlock technology that uses AI analyzes each transaction in real time and asks us if we want to accept it. Revolut cards also support 3-D Secure . And if we want to make one-time purchases on a website and we have doubts, then we can use a disposable card that changes its data after each use, so it can not be charged again.

What are the fees and limits on revolut’s free plan?

Revolut offers a completely free Standard plan (with some limits), and 3 paid plans – Plus, Premium and Metal, for more demanding people.

The plus plan is only PLN 14.99 / month, but it also gives only a few options. Mainly it is free card delivery, priority customer service, insurance of purchases and tickets, and a slightly better interest rate on savings.

Premium (PLN 29.99 per month) and Metal (PLN 49.99 per month) plans are the same with the Plus plan only better, and 2-3 higher limits on withdrawals from ATMs. In the Metal plan, we can withdraw up to PLN 3,000 / month, receive a metal card, cashback with card payments, medical insurance, luggage, flights and even own contribution when renting a car.

I just need a card in the Standard plan, but if you want to check the exact differences , here you can check the price list and benefits of plans for individuals.

There are also plans for companies and freeleancers, but I will not write about them here.

How to exchange and pay foreign currencies with Revolut?

If we want to pay with foreign currency, we do not have to do anything, because it happens on the fly at interbank rates. We must remember only about the limit of PLN 5,000 for the Standard plan and the commission on weekends, which for most currencies is only 1% anyway. That is why it is worth exchanging currency before the weekend, if we want to pay by card in stores or on the Internet during the weekend.

Online payments

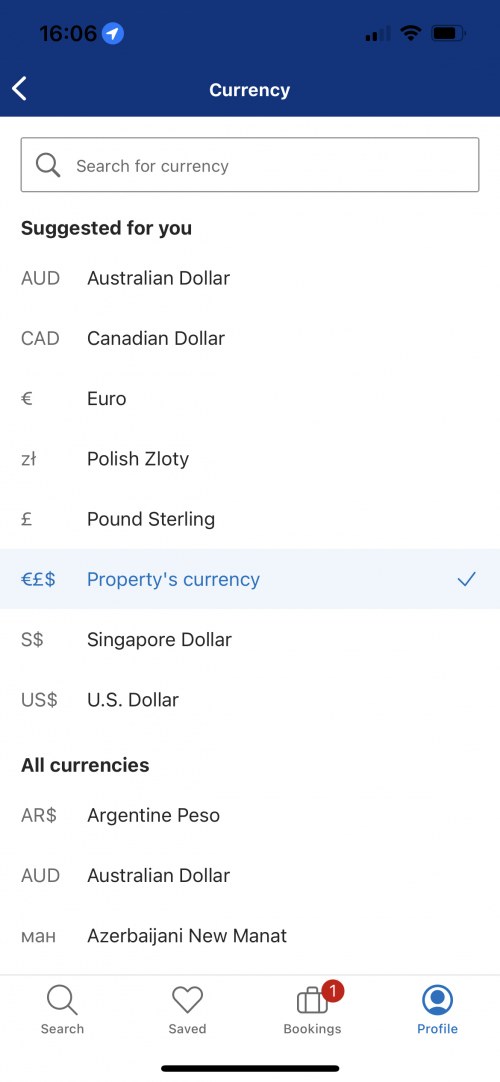

I encountered a problem where the payment given for the night in zlotys, is finally charged in a different currency, because the pages show us for convenience the price of accommodation approximately. If we pay with a Polish debit or credit card, it may hurt us if the bank converts, for example, zlotys into euros, because only in such a currency are payments accepted on the website.

For example, when booking accommodation on Booking, to be clear and there were surprises, we can immediately choose the currency of the premises and paying with a Revolut card we will pay practically what we see.

How do I withdraw cash from Revolut?

If we have a free card in the Standard plan, then we have a limit on the withdrawal of the equivalent PLN 800 or 5 transactions from ATMs without additional commission. Then it is 0.5% so there is no tragedy.

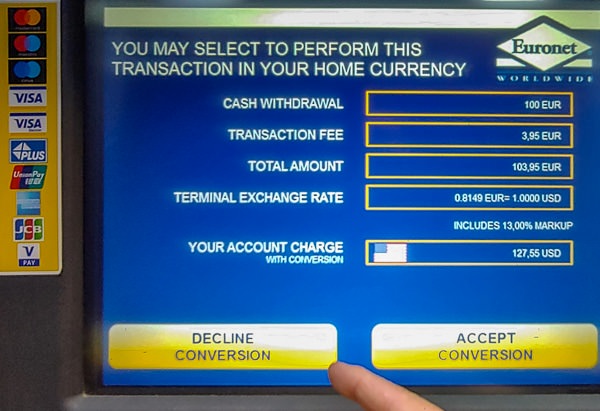

Currency conversion at an ATM

What you have to watch out for is currency conversion at an ATM, which may be charged a high commission, so always choose the option of withdrawing in the local currency, and the Revolut card will detect what to download or convert.

Euronet ATMs, etc.

What you need to avoid on vacation are Euronet ATMs. While in Poland, from Polish cards we can deposit and withdraw money in them – probably only to get us used to them. When going on vacation, let’s avoid them like fire. They almost always have a commission – even when withdrawing with a Revolut card, I heard about horrendous fees in the amount of several dozen zlotys. Euronet is the worst shit. I used them myself as a last resort, if we could not withdraw the cash we needed. Usually they collect about 4 euros of commission, with the same withdrawal without currency conversion. They are usually easy to find and in places where it is difficult to find other ATMs and they prey on it.

Free cash withdrawals from your Revolut card

Usually, in order not to pay commissions, it is worth using local banks in a given country. Below I give the whole list, but remember to withdraw in the local currency, without currency conversion (Revolut will do it to your account) and read the messages on the ATM screen.

- Albania– Credins Bank

- Andorra– Andbank, Morabanc

- England– Lloyds, other ATMs when withdrawing GBP should be commission-free

- Argentina – low commission

- Australia– National Bank of Australia, rediATM, Commonwealth Bank (no commission with Visa)

- Austria– Bank Austria/Unicredit, Bankhaus Carl Spangler, Bawag/PSK, Hypo Tirol, Sparkasse, Volksbank Tirol AG

- Belgium– ING, KBC

- Belarus– Belinvestbank

- Bolivia– BancoF

- Bosnia and Herzegovina– Unicredit, Sberbank, Nova Banka, Addiko Bank

- Brazil– Banco do Brasil, Branco Bradesco

- Bulgaria– DSK Bank, Central Cooperative Bank, United Bulgarian Bank, Fibank, SG Express Bank, Piraeus Bank Bulgaria, Eurobank, Postbank, ProCredit Bank, Tokuda Bank

- Chile– Itau Bank, Scotiabank, Banco International, Corpbanca

- China– Bank of China

- Croatia – Erste Bank, Istarska Kreditna Banka, OTP, RaiffeisenBank, Sberbank, Splitska Banka, Zagrebačka banka

- Cyprus– Alpha Bank, Bank of Cyprus

- Montenegro– Crnogorska Commercial Banka

- Czech Republic– Raiffaisen, Airbank, CSOB, Fio, Komerční Banka

- Denmark– Nordea, Nordjyske Bank

- Dominican Republic– Jumbo ATM

- Ecuador– Banco del Austro, Produbanco

- France– BNP Paribas, Credit Agricole

- Gibraltar– NatWest

- Ghana– Agricultural Development Bank

- Greece– Bank of Chania, HSBC

- Spain– Deutsche Bank, UniCaja,

- Netherlands– ABN-AMRO, ING, Rabobank

- Hong Kong – HSBC

- India– RBL Bank, Bank of Baroda, State Bank of India, Kasturba

- Indonesia– CIMB, Maybank, Bank BCA

- Ireland– Allied Irish Bank, Bank of Ireland

- Israel– Discount Bank

- Japan– 7-eleven stores (Mastercard only)

- Canada– Tangerine

- Kazakhstan– Sberbank, Halyk Bank

- Kenya– Diamond Trust Bank, Equity Bank, NIC Bank

- Kyrgyzstan – Demir Bank, Optima Bank

- Colombia– BBVA

- South Korea – Shinhan, KB Star

- Kosovo– Bkt

- Cuba– Banco Popular de Ahorro

- Latvia– Citadele Banka, Luminor Bank, SEB Banka, Swedbank

- Macedonia – Halkbank, Ohridska Banka, Sparkasse Bank

- Malaysia– Maybank, CIMB Bank

- Malta– Bank of Valleta, HSBC

- Morocco– Al Barid Bank, Banque Populaire, BMCI

- Nepal– Everest Bank, Kailash Bikas Bank, Nepal Bank Limited

- Germany– Baden-Württembergische, Commerzbank, Deutsche Bank, Hypovereinsbank, Landesbank Baden-Württemberg, Postbank, Reisebank, Santander

- Nigeria– Access Bank, Diamond Bank, UBA

- New Zealand– Westpac

- Oman– Bank Dhofar, Bank Muscat

- Peru– Bcp

- Poland – Bank Pekao SA, PKO Bank Polish, Santander;

- Portugal– Multibanco

- Russia– Gazprombank, Raiffeisen, Otrkitie Bank, BIN Bank, VTB

- Romania– BCR, Banca Transilvania, OTP Bank, Raiffaisen, ING

- Serbia– Addiko Bank, AIK Banka Jubanka, Erste Bank, Multicard ATM

- Singapore– UOB

- Slovakia– Postova Banka, Unicredit, VUB, Prima Banka

- Sri Lanka– Bank Nations Trust, Bank of Ceylon

- United States– Santander (PA), Sun East Credit Union, WSFS (PA)

- Sweden– Swedbank

- Thailand – all ATMs charge a commission, the lowest AEON 150 THB

- Tanzania– KCB Bank

- Taiwan– Bank of Taiwan, Cathay Bank, SinoPac

- Turkey – Halkbank, Akbank, Ziraat Bank

- Ukraine– UKRBank

- Uzbekistan– Capital Bank

- Hungary– Unicredit

- Vietnam – VP Bank, TP Bank, Agribank low commission

- Italy– Unicredit, Raiffaisen

- U.A.E– ADCB

nice information